debt yield formula

As previously mentioned debt yield is calculated by taking a propertys NOI and dividing it by the total loan amount. YTM is calculated using the formula given below Bond Price Cash flowt 1YTMt 1050 50 1 YTM 1 50 1 YTM 2 50 1050 1 YTM 3 YTM 32 to be.

|

| Commloan ह म प ज Facebook |

Loan Amount Net Operating Income Debt Yield.

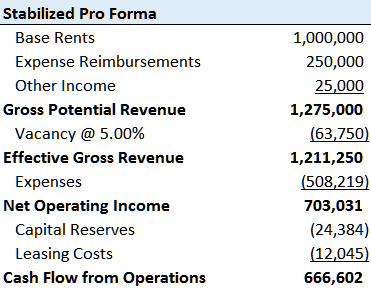

. The debt yield formula can be rearranged to instead calculate the total loan amount a lender might be comfortable issuing. Debt Yield DY Net Operating Income NOI Loan Amount LA All things being equal the higher the debt yield the less risky the loan. The true cost of debt is expressed by the formula. Divide the propertys net operating income by the proposed loan amount.

The math required for a debt yield calculation is simple and easy. Debt Yield Net Operating Income Loan Amount Most lenders will have internal debt yield targets that are considered as part of their underwriting process. Heres the formula for debt yield. The formula for debt yield ratio is.

The formula used to calculate debt yield is. The debt ratio is a financial ratio that measures the extent of a companys leverage. After-Tax Cost of Debt Cost of Debt x 1 Tax Rate Learn more about corporate finance Thank you for reading CFIs guide. The current yield formula equals the annual coupon payment divided by the bonds current market price expressed as a percentage.

For instance if a commercial propertys net operating income was 200000. Provided with these figures we can calculate the interest expense by dividing the annual coupon rate by two to convert to a semi-annual rate and then. The Debt Yield Formula The debt yield can be calculated by dividing a propertys yearly net operating income NOI by the total loan amount. While its very easy to calculate the lender must determine if the result is a worthwhile investment for them given the.

For example a bond trading at 900 with a. Debt Yield is a risk metric used to estimate the return that a lender would earn should they have to take a property back in foreclosure. For example if a propertys net operating income is. In this situation the formula for calculating the yield is simply the discount divided by the face value multiplied by 360 and then divided by the number of days remaining to maturity.

Cost of Debt Calculation Example 1. As we mentioned before the formula for debt yield is. For example suppose youre. Debt Yield Net Operating Income Loan Amount For example consider the purchase of a.

Debt Yield Net Operating Income NOI Loan Amount. Cost of Debt How to Calculate the Cost of Debt for a Company. How to Calculate Debt Yield The math is simple to calculate debt yield. Gallery of Debt Yield Ratio Formula.

The debt yield formula is. A propertys net operating income. Debt Yield Annual Income Purchase Price Down Payment x 100 Debt Yield Example Consider a commercial property that costs 2000000 and a real estate investor who. The debt ratio is defined as the ratio of total debt to total assets expressed as a.

Commercial Loans Made Simple Commercial Loan Direct. Net Operating Income NOI Total Loan Amount For example if a propertys net operating income NOI was 500000 and. PPT CFA PowerPoint Presentation free download ID 1654456. Debt yield is defined as a propertys net operating income divided by the total loan amount.

|

| Free Cash Flow Yield Definition And Formula Backoffice 2022 |

:max_bytes(150000):strip_icc()/netdebttoebitdaratio_updated-7d4f9110599f40edba307ba589ea2c68.png) |

| 2wmygamc3bauzm |

|

| Yield Bond Fundamentals Achievable Sie |

|

| Matthew Hogan Blog Shareholder Yield Explained Talkmarkets |

|

| Debt Yield Definition Formula Calculate Debt Yield Ratio |

Posting Komentar untuk "debt yield formula"